Swiss Emissions Trading Scheme (ETS)

Since 1 January 2020, aviation is integral part of the Swiss Emissions Trading Scheme (Swiss ETS). The same date also marks the start of coming into effect of the linkage agreement signed with the European Union.

Keep on reading below to learn more about Swiss ETS or jump straight to the question that you are most interested in.

Table of Contents

Swiss ETS is a cap-and-trade system designed largely in accordance with the same principles and rules governing its bigger brother the EU Emissions Trading System. It regulates a total of 56 CO2-intensive companies from the cement, chemicals and pharmaceuticals, refineries, steel, paper, district heating and other sectors. The newest addition to Swiss ETS are carbon emissions from certain aircraft movements.

Participation means adherence to the rules of monitoring, reporting and verification (MRV) and the surrendering of emission allowances to offset reported emissions.

Both Swiss based and foreign aircraft operators must participate in Swiss ETS unless they are exempt.

You are exempt from Swiss ETS:

- if you are below the Swiss de minimis threshold, and

- if you are exempt from EU ETS (see EU ETS exemption rules).

This means you are only exempt from Swiss ETS if you meet both conditions above. The Swiss de minimis threshold depends on whether you hold an AOC or not.

To be below the threshold, commercial aircraft operators must:

- operate fewer than 243 Swiss ETS qualifying flights in any of the three successive four-month periods, or

- have less than 10,000 metric tons total annual emissions from Swiss ETS qualifying flights.

With Swiss ETS qualifying flights, we mean all flights falling under the scope of Swiss ETS (see the geographical scope of Swiss ETS).

As a private, non-commercial operator, you are below the Swiss de minimis threshold if your total annual emissions from Swiss qualifying flights are less than 1,000 metric tons.

When you calculate your emissions, it’s important that you don’t count emissions from exempted aircraft and flights. Click here for a complete list of aircraft and flight exemptions.

Unless you are exempt, you have to monitor and report emissions from Swiss ETS qualifying flights and surrender emission allowances equivalent to the number of reported emissions.

So what do we mean with ‘Swiss qualifying flights’?

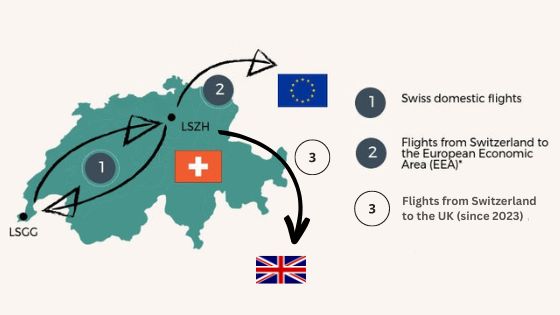

Swiss qualifying flights are:

- Swiss domestic flights,

- flights from Switzerland to the European Economic Area (EEA)*, and

- flights from Switzerland to the UK (since 2023).

The EuroAirport Basel-Mulhouse-Freiburg LFSB (EAP) belongs to France which means that flights from this airport to airports situated in the EEA are covered by EU ETS.

Furthermore, flights from the EEA to Switzerland are also covered under the EU ETS. This is the result of the linking agreement between Switzerland and the EU which we are going to discuss in the next chapter.

Compliance with Swiss ETS is largely facilitated by the linking agreement signed between Switzerland and the EU on 7 December 2017. It came into effect on 1 January 2020.

The first big advantage is that you only have one competent authority for both EU and Swiss ETS.

Your competent authority is the Swiss Federal Office for the Environment (FOEN) if you have an operating licence from Switzerland. Otherwise, you stay with your current EU ETS competent authority.

Secondly, you don’t need to create a new emissions monitoring plan. It suffices to submit your EU ETS emissions monitoring plan, a letter of approval and the Swiss accompanying declaration form (duly completed and signed) to the Swiss FOEN.

Third, you only need to submit one annual emissions report which includes both emissions from EU ETS flights (reduced scope only) and Swiss ETS qualifying flights. 2020 is the first year for which you have to submit such a combined annual emissions report. The submission deadline is the same as under EU ETS. It is 31 March, except for Spain (28 February), the Walloon Region and Czech Republic (12 March).

Before 2020, the reduced EU ETS scope did not include flights from the EEA to Switzerland. This is now history. With the linking of EU ETS and Swiss ETS, the reduced EU ETS scope has widened to also include those flights. On top of that, emissions from Swiss domestic flights and flights from Switzerland to the EEA or the UK (since 2023) further increase your emissions report total and the number of emission allowances that you need to purchase in order to meet your surrendering obligations under Swiss and EU ETS.

Lastly, you will not need to create a new Aircraft Operator Holding Account (AOHA). Although Switzerland has its own registry, the surrendering of emission allowances for compliance with Swiss ETS is done through your existing AOHA. That is the one you hold with the EEA member state administering your flight department under EU ETS. Your allowances are automatically transferred to the Swiss registry.

In terms of allowances, you can hand in Swiss or European emission allowances for compliance with EU and Swiss ETS. They are accepted in both systems. As a reminder, you have to surrender your emissions allowances by 30 April of the year following the reporting year.

* The EEA comprises all 27 EU Member States, as well as Iceland, Liechtenstein and Norway. List of EU Member States: Austria, Belgium, Bulgaria, Cyprus, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden.